Let them drink Coke

greenphillyblog.com

The Fracking Truth

William Annett Dissident Voice

(DAYTONA BEACH) My neighbor Warren doesn’t understand how much the petroleum industry has turned the economy around in the last few years. Just the other day over the back fence, he was belittling – even criticizing – our breakthrough in extractive technology. That is, until I set him straight.

“Just think of where we are today,” I pointed out, “compared with just a few years ago, when we were dependent on those wogs in the Middle East for the very oil we breathe – I mean, burn.”

“You got that right,” Warren responded. “Before long we’re going to have to drink it. Either that or depend on fracking fluid. Because we won’t have any water left.

“Even now, it’s been reported by the EPA that in California, at nine out of 11 oil well sites in the State billions of gallons of fracking waste water and other pollutants are being poured into aquifers containing fresh water used for drinking and farm irrigation. Aquifers that are supposedly protected by state law and the federal Safe Drinking Water Act. And apparently, over 100 water wells in the State already have been found to contain significant amounts of contamination from the fracturing process, largely in central California.”

“So?” was all I could answer.

“At a recent conference it was revealed that 2.5% of the total earth’s water is drinkable to begin with, and by the time mankind gets through with it, only a third of today’s world population really get a crack at drinkable water in abundance. As a physician, I find this scary.”

“Balderdash,” I snorted. “This sounds like the same scare tactics used by those who say polar ice is melting. Companies like Halliburton are rising to the challenge. Thanks to Dick Cheney’s guidance that company has already disproven the supposed threat fracking poses to our water supply.”

“What was that about?” Warren wanted to know. He’s always quizzical over anything scientific.

“It happened at a luncheon meeting, or an industry convention or what not, a year or so ago in Denver, but it had immense implications. Not realizing that he was a harbinger of a major movement to come, Dave Lesar, the CEO of Halliburton, downed a shot-glass of fracking water , right there on the stage. in defiance of industry critics and environmental alarmists. Although the glass he brandished looked pretty grubby, one observer told Fox News that it appeared to have the same luminescent color and viscosity as Jim Beam White Label.”

“I didn’t know that,” Warren admitted.

“There is more in Heaven and earth, Horatio,” I quoted, “Than is dreamt of in your philosophy.”

Warren nodded. “Yes, but was he okay after drinking that stuff?”

“Of course. He had to take a few days off, probably because he wasn’t used to the altitude in Denver. But that led to the orange flavoring of fracking water and its wider acceptance.”

“But I thought fracking water was toxic.”

“Not a bit of it,” I said. “In fact, I understand that Halliburton scientists are working on orange and other flavored beverages comprised of fracking water that will make Coke obsolete and pure water irrelevant. Apparently, they’ve even interested Warren Buffett in the project, since he’s Coca-Cola’s largest stockholder. There could be an acquisition in the works.”

“Amazing,” my medical neighbor admitted. “But then there’s another environmental danger we haven’t even talked about.”

“What’s that?”

“The sand threat.”

“I know what you’re going to say,” I scoffed, “because I read about it in some lefty journal like the Washington Post. You mean the huge demand being generated for sand used in the fracking process.”

“Exactly,” Warren said. “It takes up to four million pounds for a single well, and demand for sand is skyrocketing.”

“But I think that’s great,” I said,. “Another example of American ingenuity that is opening up a new sub-industry. All that sand right there in the Sahara, a stone’s throw, literally from the Saudis, and they haven’t even thought of the fracking process.”

“Apparently,” Warren continued, “Frack sand increases the return on investment for any individual well, and the industry will use a billion pounds of frack sand this year, up nearly 30% for the year.

“Not only that, but the trend is toward spacing wells closer together, drilling as many as 16 wells per square mile instead of the former four, resulting in an exponential increase in the demand for sand. Any market bubble like that, I find a little scary.”

“Don’t be silly,” I pointed out, ”market bubbles are as American as cherry pie, as LBJ used to say. The Wall Street Journal noted that approximately one-fifth of onshore wells are now being fracked with extra sand, while the trend could spread to 80% of all shale wells. Oilfield services giants such as Halliburton Co. and Baker Hughes are stockpiling sand now, hoping to shield themselves from rising costs, according to Reuters news agency.

“I’ve read that Wisconsin. Because of its sensible Republican Governor, who consistently overcomes recall campaigns, has been a major frac sand venue, with over 100 sand mines.

“Think of the possibilities, Warren. Oil companies can now start to market all of our formerly useless sand – such as all along the length of Daytona Beach and, hey, even in California, in such places as Malibu, which is even closer to those fracking wells you were so worried about.”

“I see what you mean,” Warren admitted.

“If I was a little younger,” I mused, “I’d start a company and start buying up chunks of the Mojave Desert. Corner the sand market, you might say.”

“I have to hand it to you,” Warren marveled. “When it comes to business, you certainly are visionary.”

“I’ve been told that,” I admitted. “The only difference between me and Warren Buffett is that he has more money.”

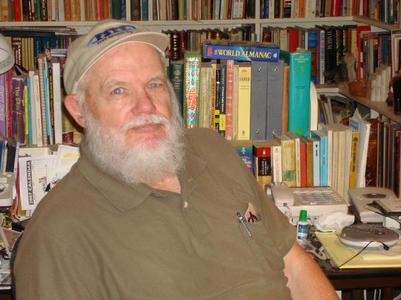

Bill Annett writes four newsletters: The Canadian Shield, American Logo, Beating the Street, and The Oyster World. He can be reached at: [email protected].

________________________________________________________

Bill Annett grew up a writing brat; his father, Ross Annett, at a time when Scott Fitzgerald and P.G. Wodehouse were regular contributors, wrote the longest series of short stories in the Saturday Evening Post’s history, with the sole exception of the unsinkable Tugboat Annie.

At 18, Bill’s first short story was included in the anthology “Canadian Short Stories.” Alarmed, his father enrolled Bill in law school in Manitoba to ensure his going straight. For a time, it worked, although Bill did an arabesque into an English major, followed, logically, by corporation finance, investment banking and business administration at NYU and the Wharton School. He added G.I. education in the Army’s CID at Fort Dix, New Jersey during the Korean altercation.

He also contributed to The American Banker and Venture in New York, INC. in Boston, the International Mining Journal in London, Hong Kong Business, Financial Times and Financial Post in Toronto.

Bill has written six books, including a page-turner on mutual funds, a send-up on the securities industry, three corporate histories and a novel, the latter no doubt inspired by his current occupation in Daytona Beach as a law-abiding beach comber.

You can write to Bill Annett at this address: [email protected]

London

London

Oregon

Oregon

Leave a Reply

You must be logged in to post a comment.